Types of Financial Documents You Should Keep Track of

In the world of business, being organized is everything. Amid running your venture, ensuring quality, meeting client needs, and maintaining seamless operations, another element is of prime importance - keeping track of financial documents. You might be wondering why? The straightforward answer is that your business's precise financial standing is depicted through these papers. Whether it's a startup or a thriving firm, a solid financial roadmap cannot be attained without comprehensive financial documents.

Here, we'll guide you through various financial documents playing an essential part in your firm’s prosperity and how to keep track of them effectively.

**1. Income Statements**

Also known as profit and loss statements or statement of operations. It reflects the firm’s profits and losses over a specific period, typically a quarter or a year. This document reveals the costs, expenditures, revenue, and net earnings that can be used to evaluate the performance and plan essential monetary decisions.

**2. Balance Sheet**

The balance sheet provides an overview of the company's financial health at a specific moment. It involves everything your company owns (assets), owes (liabilities), and equity represents ownership interests by detailing the comparison between asset value versus liabilities. A sturdy balance sheet is likely to attract potential investors.

**3. Cash Flow Statements**

The cash flow statement is another essential document detailing the inflow and outflow of cash within your firm. This includes both operational activities and investments. This helps the business track each penny and aids in managing the company’s liquidity.

**4. Bank Statements**

Your monthly bank statements give you a detailed account of every transaction. These kinds of statements help businesses monitor expenses, manage their budget, and prepare tax reports. Additionally, bank statements serve as proof of income and expenditures when dealing with creditors or applying for a loan.

**5. Purchase Orders and Invoices**

Purchase orders establish the details of what a company has ordered from their suppliers, while invoices record the sales made to customers. Both documents form the basis of any business transaction and should be meticulously saved to track order history and maintain smooth transactions.

**6. Receipts**

Never underestimate the power of keeping your receipts. They not only act as proof of purchase but also aid in balancing your books. Receipts provide validation for expenses written off against income during tax preparation.

**7. Tax Returns and Payroll Records**

Tax documents are legal requirements and need to be saved for at least three years in case of an IRS audit. Payroll records, including salary payments, bonuses, and benefits contributions, should also be stored correctly to ensure accurate employee information.

**8. Contracts and Agreements**

Any legally binding documents should be stored carefully for future reference and to fulfill any legal requirements.

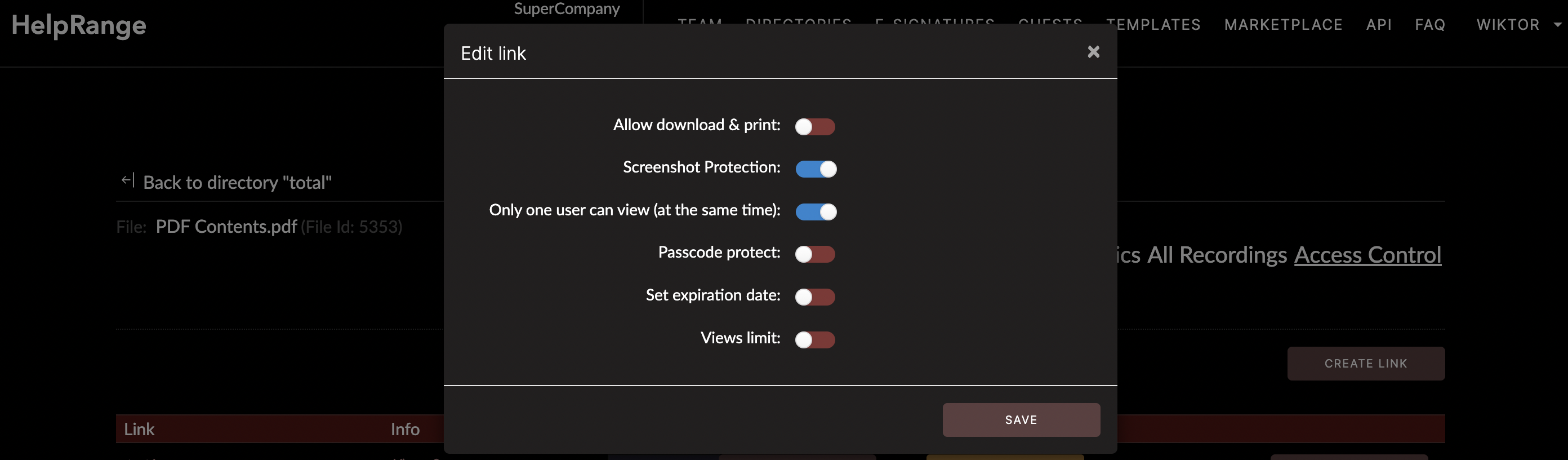

Now that we've established the types and importance of financial documents let's talk about the storage and tracking method. It’s essential to use a dependable system that'll help ensure your financial information remains secure and accessible. For this purpose, digital tools are an excellent choice. In addition to offering security features, they also provide document protection and usage analytics.

In conclusion, keeping track of your financial documents is not merely a chore that should be done – it's a crucial part of your company's overall financial health. From documenting earnings and expenses to compliance with legal requirements, organized record-keeping will make it easier to measure progress, make data-based decisions, and ensure your business's long-term success. Implementing modern tools like HelpRange will make this task decidedly less daunting, allowing you to focus more on reaching new heights in your business.

Check out HelpRange

HelpRange is "Next-Gen Documents Protection & Analytics Platform". HelpRange represents the cutting-edge platform for document access controls and in-depth analytics, ensuring superior management and usage insights for your documents.