Online Contract Signing in the Finance Industry

In the finance industry, contractual agreements form the cornerstone of all transactions. Such documents, always crafted with careful precision, encode the value exchange in unmistakable terms and set the standard for the scope of work that will follow. For decades, these crucial documents were signed in a relatively traditional manner - with a pen on paper, followed by time-consuming and risk-prone physical delivery. However, the digital revolution has facilitated fundamental changes in all sectors of the economy, and the finance industry has not been left behind. Online contract signing is now an essential part of the financial world, largely due to its ubiquitous accommodation to global business dynamics and technological integration.

The convenience of online contract signing lies in its ability to provide an easy, secure, and faster way for individuals and businesses to agree on terms without the need for physical presence. Its widespread usage in the finance industry points to variegated benefits that far outweigh the traditional way of inking contracts on paper.

One of the primary benefits is that online contract signing eliminates geographical barriers. Stakeholders in the finance industry often have a global reach; clients, vendors, associates, and partners could be scattered across corners of the globe. Previously, signing contracts in this context meant dealing with time-consuming and expensive international couriers. With online contract signing, important agreements can be finalized in minutes, with all parties involved be they in New York City, London, or Tokyo.

The finance industry, unlike many other industries, often involves the exchange of large sums of money. As such, secureness is paramount. Online contract signing solutions come engineered with high-end security features to ensure the integrity of the documents. The contracts signed online come embedded with digital signatures that are difficult to forge, providing a secure platform to transact.

Then there's the question of compliance. Regulatory guidelines for the finance industry vary from region to region. By using software solutions compliant with essential regulations like the US's ESIGN Act and European Union’s eIDAS regulations, financial institutions can be confident that their online signatures hold the same weight as their manual counterparts, demystifying validation concerns.

Integration capability of online contract signing solutions with existing processing systems is a key feature which allows for seamless digitization of the contract process, right from drafting to signing and storing. It optimizes the process further by reducing turnaround times and enhancing customer satisfaction.

However, in availing online contract signing possibilities, the question of an efficient and effective tool becomes a critical consideration. To choose the right offering, an evaluation must cover factors like secureness, user-friendliness, compatibility, storage possibilities, and cost.

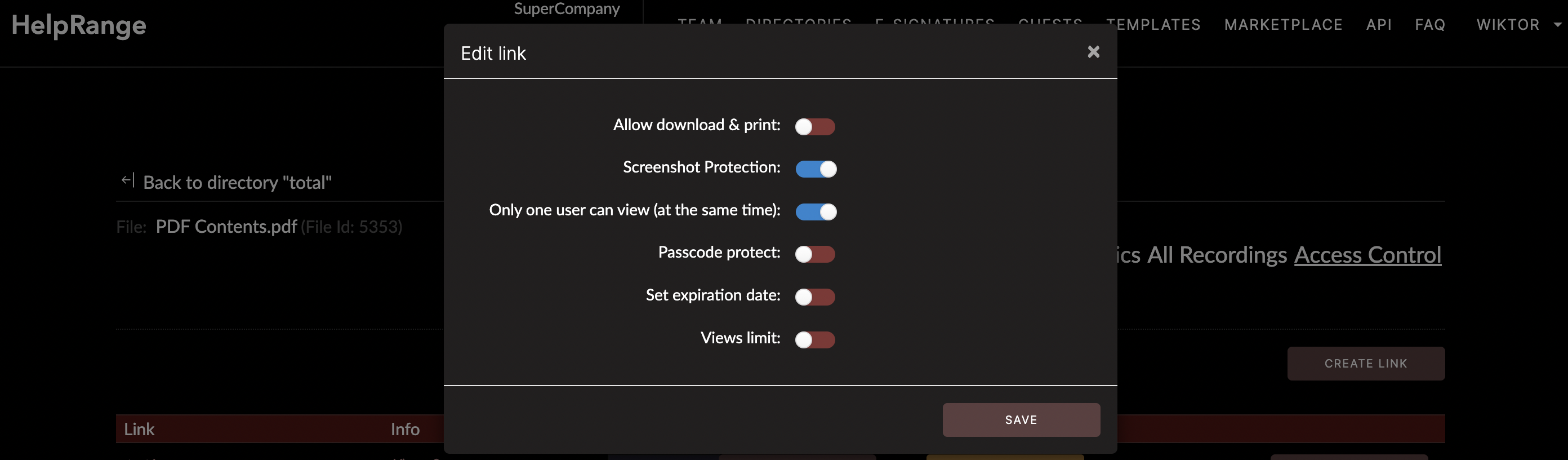

For instance, platforms like HelpRange offer a suite of features including PDF/document protection, where documents are not only encrypted but also provide the ability to limit access by setting up passwords or restricting sharing. Additionally, HelpRange provides real-time PDF usage analytics that can provide insightful statistics on document usage patterns. Having knowledge of how, when, and where your contract is being accessed or used can help in making strategic decisions.

In essence, the world has moved past the pen and paper mode of signing contracts. The finance industry, no stranger to technological adoption, has embraced online contract signing as a natural progression to facilitate faster, efficient, and secure contract management. With the right tools in place, financial institutions can take full advantage of the time and cost efficiencies to focus on their core business, growth, and customer satisfaction.

In conclusion, online contract signing in the finance industry has come a long way and doing away with traditional, paper-based processes has not only helped businesses cut costs and save time, but also fostered the ability to scale and grow at an exponential rate. As digital practices continue to improve, they will undoubtedly move business performance to the next level, ultimately delivering significant advantages to all stakeholders involved in the financial ecosystem.

Check out HelpRange

HelpRange is "Next-Gen Documents Protection & Analytics Platform". HelpRange represents the cutting-edge platform for document access controls and in-depth analytics, ensuring superior management and usage insights for your documents.