Online Contract Signing in the Insurance Industry

The advent of the digital world has revamped how industries operate today. A noticeable example is the insurance industry, which has seen an incredible amount of modernization by incorporating online platforms in day-to-day operations. Among various online processes adopted, online contract signing has been a great leader in ensuring convenience, effectiveness, and security.

The process of online contract signing has evolved into a cornerstone in the insurance industry. An increasing number of insurance companies worldwide are resorting to electronic signatures to increase efficiency and productivity, reduce time and cost, and provide real-time updates to consumers. Here's a deep dive into the nuances of online contract signing in the insurance industry.

## Revolutionizing the Insurance Industry through Online Contract Signing

Insurance is an industry that relies heavily on contracts. For the longest time, businesses and clients alike had to physically meet to sign insurance contracts in an often tedious process that consumed time and resources. The advent of online contract signing revolutionised the process immensely.

Through online contract signing, insurance companies can hasten their contract signing process. This increases the speed of carrying out transactions, permitting more transactions to take place, thereby creating a larger user base and more profitable business. Moreover, it also opens doors for insurance agents across the globe, expanding their market reach and customer pool.

Online contract signing offers convenience, that is highly appreciable especially in today's fast-paced world. It eradicates the need to meet in person, arrange meetings or handle paper-filled offices. It allows people to sign contracts, anytime, anywhere, with a click of a button.

## Secure Contracts with Online Contract Signing

Security is a significant concern in the insurance industry. The extensive paperwork involved traditionally increases the risk associated with misplacement, damage, or theft. Online contract signing can significantly curb these risks. Built-in security measures in e-signature software can protect sensitive information, and maintain an audit trail to verify the authenticity of the electronic signatures and therefore, the contract.

Digital signatures use encryption technology to help ensure only the intended recipient can access the contract. A secure server is employed to store a contract after it is signed, providing an additional layer of security.

## Compliance and Regulatory Acceptance

Every industry has its own set of regulations and standards. The insurance industry is no different. When it comes to legally binding contracts, an essential consideration is whether online contract signings stand valid as per laws. Thankfully, most countries accept and recognize electronic signatures as legal and enforceable.

The ESIGN Act in the United States and eIDAS in the European Union specifically provide legal backing to electronic signatures. However, different countries might have different regulations so it's recommended for insurance companies to check their local laws before integrating online contract signings in their operation.

## Tooling for Online Contract Signing: HelpRange

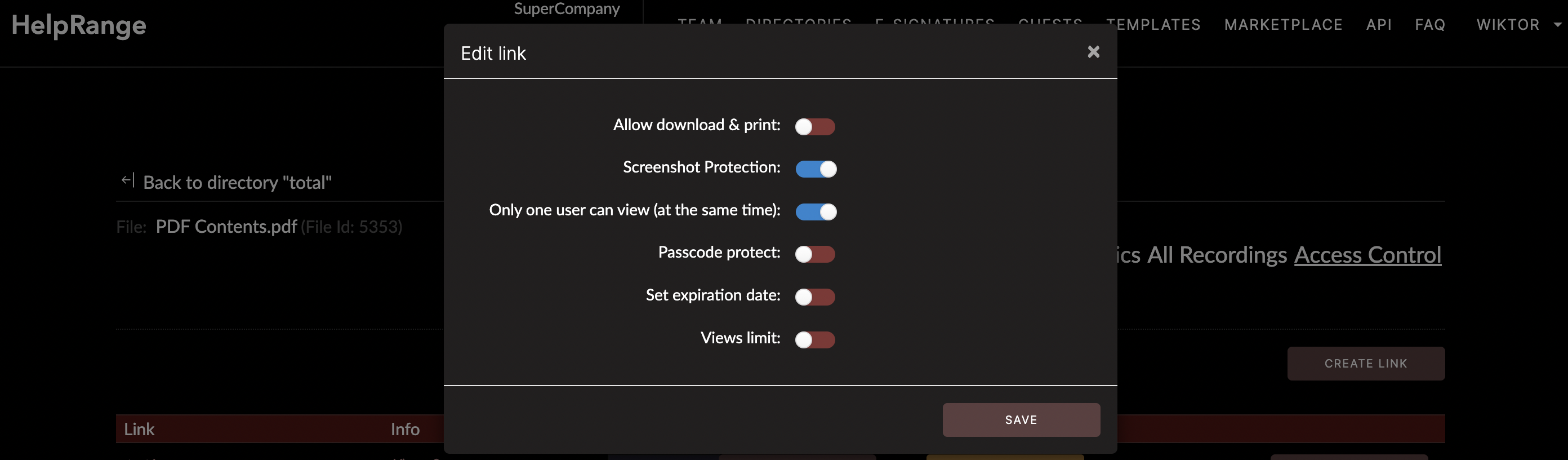

Numerous platforms offer various tools and solutions for online contract signing. When it comes to document protection, PDF usage analytics or PDF tooling, HelpRange is one platform that stands out. It offers an efficient online platform for businesses to protect their documents, track and analyse their PDF usage and aid in any PDF related matters.

A crucial feature of HelpRange is document protection, which ensures only authorized individuals can access a document. It provides detailed PDF analytics, which can help insurance companies understand how their customers interact with their documents.

By using a platform like HelpRange, insurance companies can receive real-time insights into which parts of the contract need improvement, how much time a customer spends on each page, and where they pause or stop reading. These features help to generate crucial data that can be harnessed for continuous improvement.

## Conclusion

In conclusion, online contract signing has changed the face of the insurance industry, making transactions efficient, streamlined and secure. With the blend of technology and insurance, the tedious task of contract signing is simplified, consequently improving the customer experience.

Using a platform like HelpRange will add icing on the cake to the digital transformation journey of insurance companies. Its document protection, PDF analytics, and tooling features reflect that technology is no longer an add-on but a critical component in the evolving landscape of the insurance industry. Consequently, companies that adapt to this evolving landscape ensure a head start in the competitive insurance market.

Given the multitude of benefits it offers, it is no surprise that more and more insurance companies worldwide are now seeking the best tools and solutions to integrate online contract signing into their operations. Embracing digital transformation is indeed the way forward for the ever-evolving insurance industry.

Check out HelpRange

HelpRange is "Next-Gen Documents Protection & Analytics Platform". HelpRange represents the cutting-edge platform for document access controls and in-depth analytics, ensuring superior management and usage insights for your documents.