Investment due diligence guide

In the world of finance and business, making informed investment decisions is essential

for success and growth. Investment due diligence is a critical process that helps

investors and businesses assess potential opportunities and risks before committing

capital. In this comprehensive guide, we'll delve into the key components of investment

due diligence and offer valuable insights to help you navigate this intricate landscape

with confidence. Additionally, we'll introduce HelpRange, an online tool that not only

provides robust PDF/document protection but also offers PDF usage analytics, enhancing

your document security and analysis during the due diligence process.

Understanding Investment Due Diligence

Investment due diligence is a meticulous process that involves assessing and analyzing

various aspects of an investment opportunity to ensure its viability and potential for

returns. This process is crucial for mitigating risks, making informed decisions, and

maximizing the chances of a successful investment outcome. Here's a step-by-step guide

to help you navigate the investment due diligence process effectively:

Step 1: Define Your Investment Goals and Criteria

Start by outlining your investment objectives, risk tolerance, and criteria. Clearly

define what you aim to achieve with the investment and the specific parameters that a

potential opportunity must meet.

Step 2: Conduct Preliminary Research

Gather general information about the market, industry, and competitors related to the

investment opportunity. This will provide context for evaluating the potential

investment.

Step 3: Evaluate Financial Performance

Analyze the target company's financial statements, performance metrics, and historical

trends. Assess factors like revenue growth, profitability, liquidity, and debt levels.

Step 4: Assess Management and Leadership

Examine the management team's qualifications, experience, and track record. Strong

leadership is often a key driver of a company's success.

Step 5: Investigate Market and Competitive Landscape

Understand the market dynamics, trends, and competitive landscape relevant to the

investment. Assess the potential for growth and sustainability within the industry.

Step 6: Review Legal and Regulatory Compliance

Ensure that the investment opportunity complies with relevant laws, regulations, and

industry standards. Identify any potential legal risks or liabilities.

Step 7: Analyze Risks and Mitigation Strategies

Identify and assess potential risks associated with the investment. Develop strategies

to mitigate these risks and create contingency plans.

Step 8: Perform Valuation Analysis

Determine the fair value of the investment using various valuation methods, such as

discounted cash flow (DCF) analysis, market comparables, and asset-based valuation.

Step 9: Make an Informed Decision

Based on the comprehensive due diligence process, make an informed investment decision.

Consider all the information gathered, risks, potential returns, and alignment with your

investment goals.

Introducing HelpRange: Elevating Document Security and Analysis

In the due diligence process, maintaining the confidentiality and security of sensitive

documents is paramount. This is where HelpRange comes into play. HelpRange is an online

tool that offers robust PDF/document protection and PDF usage analytics, enhancing both

document security and analysis during the investment due diligence process.

Key features of HelpRange include:

Document Encryption: HelpRange employs advanced encryption algorithms to ensure your documents remain secure and confidential throughout the due diligence process.

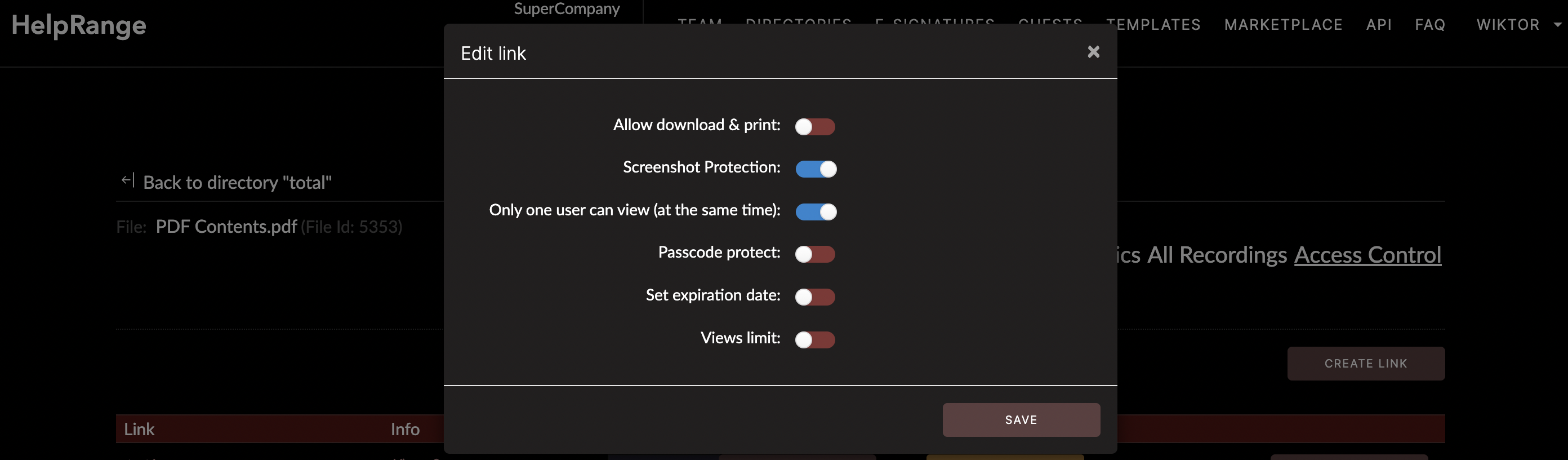

Password Protection: You can set passwords for your PDFs, granting access only to authorized individuals involved in the due diligence process.

Usage Analytics: HelpRange provides valuable insights into how your documents are being accessed, viewed, and interacted with. This can help you gauge the level of interest and engagement from potential investors or stakeholders.

Access Control: Define user roles and permissions within HelpRange to control who can view, edit, or download your sensitive documents.

User-Friendly Interface: HelpRange's intuitive platform makes it easy to protect your documents and gain insights, even if you're not a tech expert.

Key features of HelpRange include:

Document Encryption: HelpRange employs advanced encryption algorithms to ensure your documents remain secure and confidential throughout the due diligence process.

Password Protection: You can set passwords for your PDFs, granting access only to authorized individuals involved in the due diligence process.

Usage Analytics: HelpRange provides valuable insights into how your documents are being accessed, viewed, and interacted with. This can help you gauge the level of interest and engagement from potential investors or stakeholders.

Access Control: Define user roles and permissions within HelpRange to control who can view, edit, or download your sensitive documents.

User-Friendly Interface: HelpRange's intuitive platform makes it easy to protect your documents and gain insights, even if you're not a tech expert.

Conclusion

Investment due diligence is a crucial process that requires thorough analysis and

careful consideration. By following the steps outlined in this guide and utilizing tools

like HelpRange for document protection and analysis, you can enhance your due diligence

efforts and make more informed investment decisions. Remember that due diligence is an

ongoing process, and staying vigilant throughout the investment lifecycle is key to

achieving success and minimizing risks. Explore HelpRange today to experience heightened

document security and insights, and embark on your investment journey with confidence.