Signing Documents Online in the Banking Industry

The banking industry is often characterized by stringent security protocols, cumbersome documentation, and endless paperwork. However, with the dawn of the digital era, businesses are continually revolutionizing their operations. A significant shift has been observed in the banking sector where most banks have now started relying heavily on online services for most tasks, right from account opening to loan processing. Among all the operations, signing documents online has emerged as a remarkable innovation that has transformed how banks carry out contracts and agreements.

Let's delve into what Online Document Signing is:

Online document signing is a procedure where electronic signatures are used to validate a digital document. It's as simple as attaching your signature to a digital file, much like you would do to a paper document, except that it is entirely online, eliminating the need for physical copies or presence.

This online means of signing documents is not just comfortable and convenient but also equally valid as traditional pen-on-paper signatures. The ESIGN Act of 2000 recognised electronic signatures’ legalities, ensuring that they held as much weight legally as a traditional signature.

The impact and the role of online document signing in the banking industry cannot be underrated because:

Increasing Efficiency:

A palpable advantage of signing documents online is the increased efficiency. Banks and other financial institutions handle massive amounts of paperwork, and shifting to a digital platform accelerates these processes significantly. For instance, processes such as loan approvals, that once took a few days, can now be accomplished within a few hours.

Cost-Effective:

Online document signing drastically reduces the operational cost that banks had to incur because of physical paperwork. There's no need for paperwork, printing, storage or transportation costs.

Improved Customer Experience:

Gone are the days when customers had to make countless trips to the bank for signing documents. Now, with just a few clicks, documents can be signed online, enhancing user experience. Besides, online document signing is not bound by time or place constraints, thus making it easier for geographically dispersed clients.

Maintaining Records:

Signing documents online helps to keep track of the records easily. Every document and every signature is stored and maintained on a digital platform, making future reference easy and convenient.

Privacy and Security:

Most online document signing software provides advanced security features, ensuring the documents' safety and the signatures.

As much as online document signing seems appealing, it's crucial to explore the tools or platforms that facilitate this process. Numerous online tools provide services for online document signing, along with additional features such as document protection, tracking, document analytics and so on.

For instance, DocuSign is a popular e-signature tool. It provides a secure and speedy way to sign documents, contracts, and forms. Adobe Sign is another such tool that allows you to create, edit, sign, and track PDF forms.

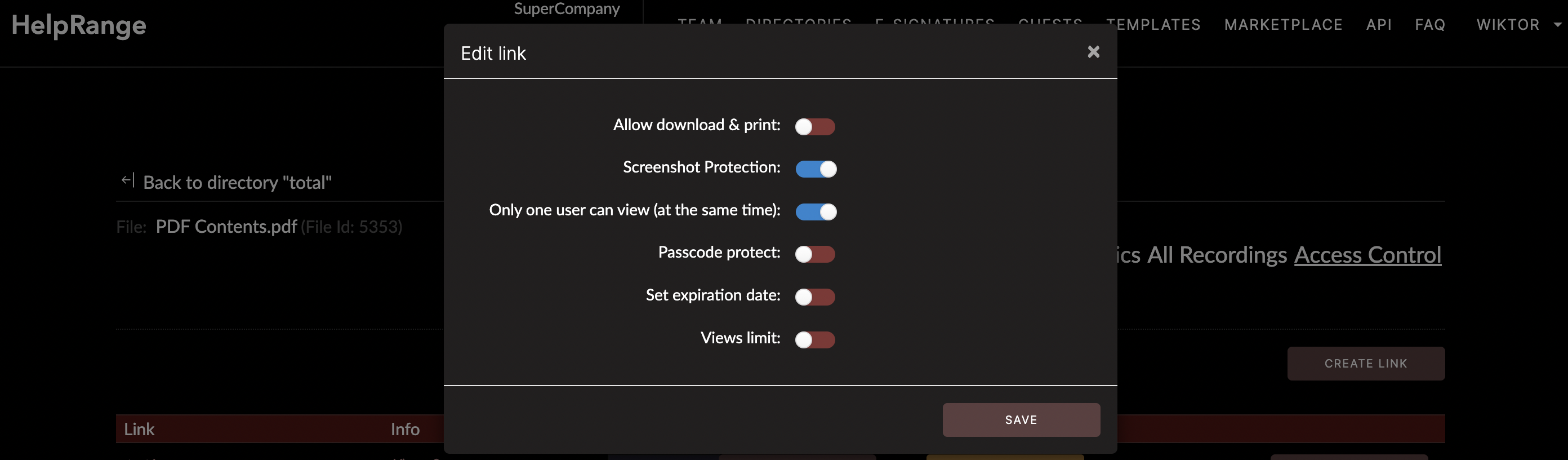

The online platform HelpRange is also an effective tool offering a range of services in addition to document signing. With its advanced security features, it is an excellent tool for the banking sector where sensitive information is constantly exchanged. Furthermore, it provides features like PDF/document protection, PDF usage analytics, and a range of PDF tooling options that make document management and handling a breeze.

In conclusion, while signing documents online in the banking industry, we are taking significant strides towards a paperless world and efficient banking processes. The integration of technology is helping banks reduce overhead costs, offer better customer service, and make transactions smoother and quicker for customers worldwide. Tools such as DocuSign, Adobe Sign and HelpRange will certainly assist the industry in navigating through this digital transformation effectively and efficiently. With the right tools, banks and financial institutions can leverage digital signatures to optimize their operations, ensuring trust and satisfaction among their clients.

Check out HelpRange

HelpRange is "Next-Gen Documents Protection & Analytics Platform". HelpRange represents the cutting-edge platform for document access controls and in-depth analytics, ensuring superior management and usage insights for your documents.