Signing Documents Online in the Insurance Industry

The insurance industry is notoriously paper-intensive. From proposals and applications to policies and claims, countless documents pass through the hands of agents, brokers, adjusters, and clients. However, with the advent of digital technology, the industry is now steadily evolving its way of doing business by utilizing digital tools, like online document management systems and electronic signatures, to simplify processes, improve efficiency, and enhance the client's experience. And one area where the digital revolution has made significant strides is in signing documents online.

Online document signing, also known as electronic or e-signing, has transformed the way the insurance industry handles paperwork. E-signing is an electronic indication of intent to agree on the contents of a document. It enables parties involved in a transaction to digitally sign contract documents, statements, policies, and claims, eliminating the need for paper documents and physical signatures.

Many global jurisdictions now consider electronic signatures legally binding, with provisions on legality and enforceability varying from one jurisdiction to another. This advancement has undeniably increased the popularity of online document signing in the insurance industry, as it seeks to drive operational efficiency and boost customer satisfaction.

For instance, e-signatures significantly speed up processes. Whereas traditional methods could take days or weeks to get documents sent, signed, and returned, electronic signing can turn this into a matter of minutes. Agents can send documents to clients digitally, clients can sign them anywhere at any time, and the signed documents can be returned instantly. This quick turnaround can greatly impact the client's experience by minimizing delays and streamlining the entire process.

Another advantage of e-signing is its cost-effectiveness. Printing, faxing, mailing, and storing paper documents can be costly. By transitioning to digital signatures, the insurance industry can significantly reduce operational costs by eliminating these expenses.

Moreover, electronically signed documents can be stored digitally, giving way to easier and more secure file management. Digital storage reduces the risk of loss or damage to signed documents. It also enables easier access and retrieval of documents when needed.

The level of security provided by e-signatures is another critical factor why this technology is gaining traction in the insurance industry. Many e-signature tools feature robust security protocols that ensure the integrity and authenticity of digital signatures. They use encryption technologies, secure server networks, and certificate-based digital IDs to secure documents and validate users.

Companies like Adobe Sign and HelloSign offer popular electronic signature solutions, while others such as Docusign take it up a notch by incorporating artificial intelligence in their platforms. These tools feature various functions like signature verification, real-time tracking, and customizable templates that aid in the seamless implementation of online document signing.

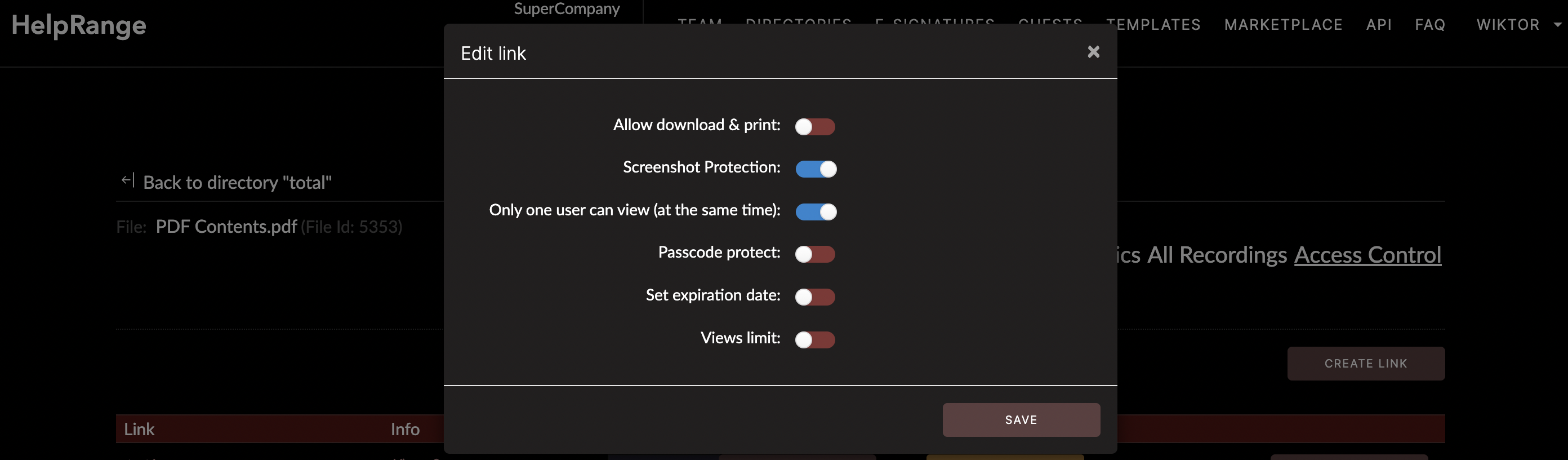

For comprehensive PDF tooling and protection, including analytics, a platform like HelpRange stands out. The platform not only makes online document signing possible but also provides impressive security features, usage insights, and robust access controls. This can be particularly useful in the hierarchical and highly confidential nature of the insurance industry: you can easily control who accesses certain documents and keep track of how they engage with them — an all-in-one solution that can benefit insurance firms in many ways.

Despite the initial resistance owing to concerns about legal acceptance, security, and altering long-standing workflows, the benefits of online document signing in the insurance industry are clear and undeniable. As the world becomes increasingly digital, transitioning to online methods, particularly in document handling and signing, is imperative to stay relevant and competitive. It decreases operational costs, increases efficiency, improves the client's experience, and above all, it embraces the digital era, placing the insurance industry on par with other sectors already maximizing the benefits of digital technologies.

With the right tools in place, like HelpRange’s online document management and e-signature solutions, the transition can be seamless. And as we continue to navigate the future, the insurance industry can expect to see the increasing adoption and continuous development of these digital tools and solutions, reshaping the way it operates and serves its clientele.

Check out HelpRange

HelpRange is "Next-Gen Documents Protection & Analytics Platform". HelpRange represents the cutting-edge platform for document access controls and in-depth analytics, ensuring superior management and usage insights for your documents.